I hope you are having a pleasant summer. Mine has been filled with tending to details: updating mailing lists, filling out and fine-tuning a new constituent relationship management platform, watching social media postings by the community (and responding), cleaning-up and uploading documents into the cloud for safekeeping, thanking constituents for their support, setting up a fall fundraising event webpage, and more.

Summer is a great time to perform routine but essential tasks like these. Some of my colleagues lament they are bored during the summer months. But I never am!

With many on vacation, there is quiet time to think and prepare for the fall. I know some of us have staff, but I find tending to details myself – by hand – can result in some critical insights. For example, I have learned how some donors prefer to give, and what banks they prefer by studying the vehicles they use for transmitting gifts. Why does this matter? While ramping-up for a major gift campaign, I am eagerly seeking out those within the community who have contacts with banking institutions with donor advised funds. Banking institutions listen to those who bank with them.

Looking at how people donate is something I have studied since the beginning of my career in the 1980s. Is the check (or today, the e-payment) coming from their personal account, from their foundation(s), a community foundation, or from their company? These insights help me understand what they prefer and perhaps, what might be possible.

Donor Advised Funds: New Research

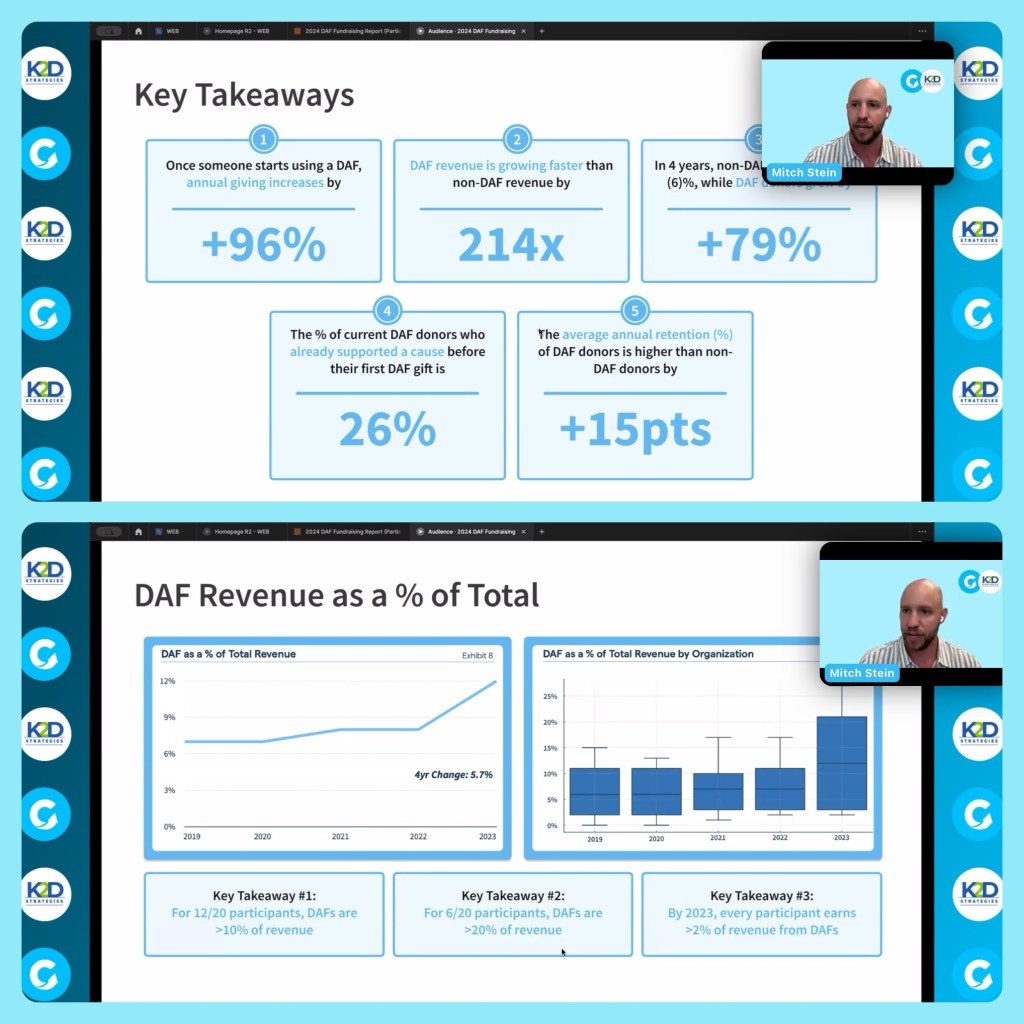

I enjoyed a webinar hosted by K2D Strategies about donor advised funds hosted in July. I learned about the event on LinkedIn. Below are a couple of iPhone screen captures from the online event, which was eye-opening!

Many of my nonprofit colleagues lament the rise of DAFs, but the fact is, the nonprofit sector might consider not fighting the trend, but leaning into it.

Barron’s notes in, “Donors Who Give Through DAFs Tend to Be Generous Contributors, Study Finds” (July 23, 2024):

The study, which looked at DAF-related data from 2019 to 2023 that was provided by the nonprofits, found that among the 20 organizations studied, DAF-generated revenue grew by 214% from 2019-23. At the same time, the revenue sourced from donors outside of DAFs rose by only 1%, illustrating a “really drastic comparison,” Kirchoff said.

Our sector still has a lot to learn about working with professional advisors and donor advised funds. Let’s hope there are more educational programs in the months ahead to guide us. While I always prefer meeting with donors and potential donors myself, sometimes this is not possible. But how to gain an audience with a professional advisor? This is an ongoing quest.

Professional Advisors: Small Nonprofits Need Your Attention

For those who are professional advisors, I continue to hope more funds will be awarded to smaller nonprofit organizations and to “startups.” Akin to small businesses, these organizations often work harder and smarter, and they are highly creative in achieving their goals. The Export-Import Bank of the United States reviews the role of small businesses in our economy.

According to the Small Business & Entrepreneurship Council (SBE Council) businesses with less than 500 employees make up over 99 percent of all businesses in the U.S., while those with fewer than 20 employees still make up close to 90 percent of all businesses. Evidently, this proves that the vast majority of all businesses are small businesses! The Small Business Administration (SBA – via the SBE Council) further note that close to two-thirds of all job creation in the country comes from small businesses. Moreover, the vast majority (close to 95 percent) of all businesses exporting to overseas markets are also small businesses. All-in-all, it is not surprising that many quote that small businesses are the engine of our economy!

But I do see a continuing trend by donors using donor advised funds (and professional advisors), to fund only large nonprofit organizations. This is short sighted and may result from a failure to understand our sector. The National Council of Nonprofits points out myths about nonprofits, one of them being:

Myth: Most nonprofits are large and have many resources

Reality: In fact, most nonprofits are small in both budget size and numbers of employees. While large, well known nonprofits, such as the Red Cross, have high visibility, those nonprofits are actually not representative of the charitable nonprofit community as a whole. 92 percent of all reporting public charities had annual revenue of under one million dollars.

Hence, to my followers in the field of professional advising, please check out the National Council of Nonprofits website for these and other statistics, and consider steering your donors also to younger, smaller, problem-solving organizations. Thank you!

Be safe in these challenging times, and very best wishes for your fundraising success.

My mission is to help organizations, communities, donors and volunteers attain their fundraising, digital communications and public relations goals in the most efficient, thoughtful, high-quality manner possible. I am an independent nonprofit fundraising and communications expert with forty years of experience working across Texas (and beyond).

Carolyn’s Nonprofit Blog was launched in 2011. Based on personal interests and experiences, it shares my work in the “trenches” of nonprofit organizations small and large. Both the wonderful and the challenging moments are shared. These discussions are meant to help readers learn how I achieved success in fundraising and communications, and also to share that while occasional missteps happen naturally in life, one can recuperate and thrive once you deal with and move past them. Never say never!

You might enjoy reading one of my popular posts, “Building Relationships with Professional Advisors.” Its popularity indicates my colleagues are searching for help with this topic.

Leave a comment